正版软件

持续更新

放心使用

售后无忧

【苹果彩虹微商微信分身多开激活码】本地500M大视频上传

成为代理价格更低

¥新品特价39.8.00

¥1988.00

成为代理价格会更低

2778

累计浏览人次

建议使用微信扫一扫添加收藏

随时随地访问

随时随地访问

正文

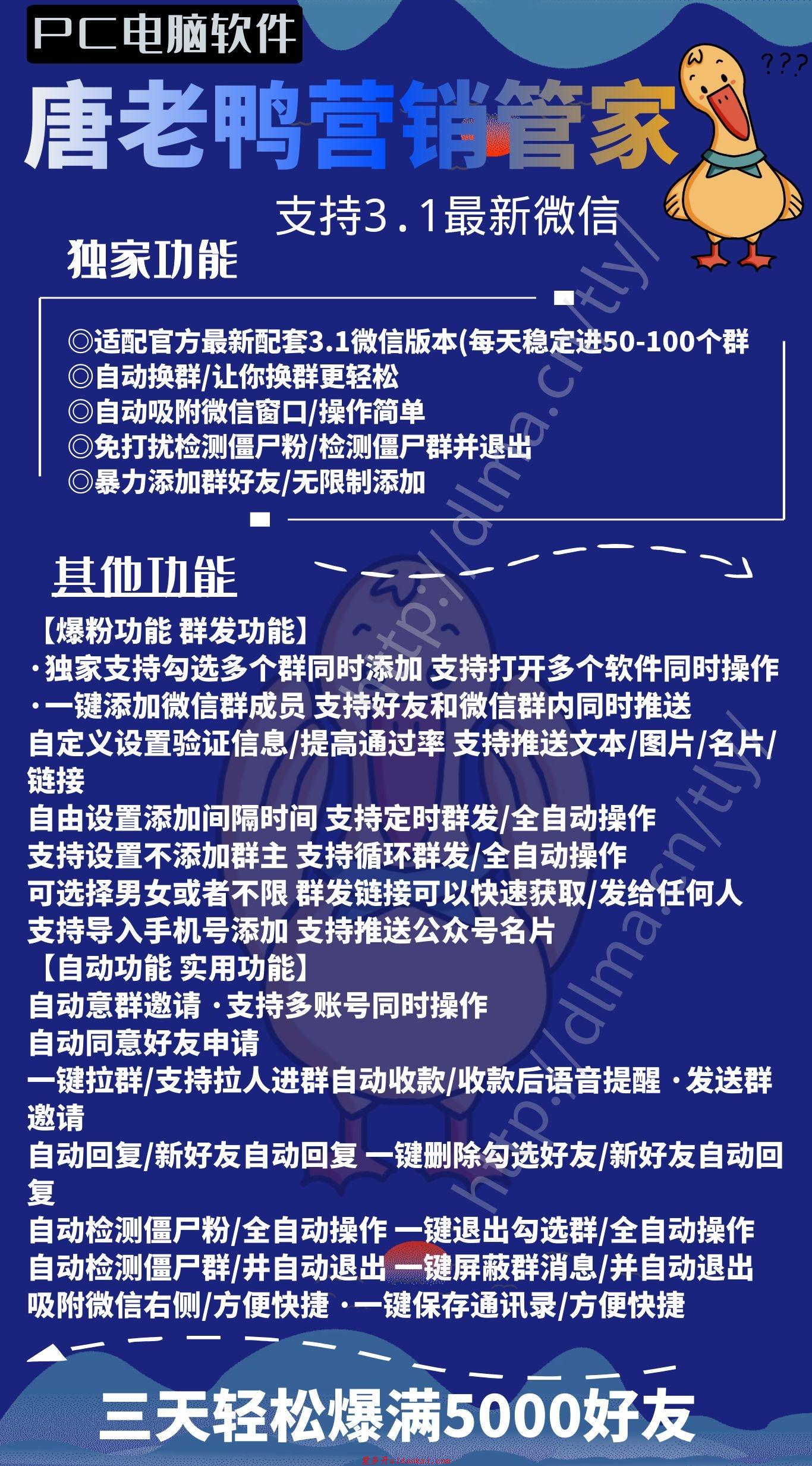

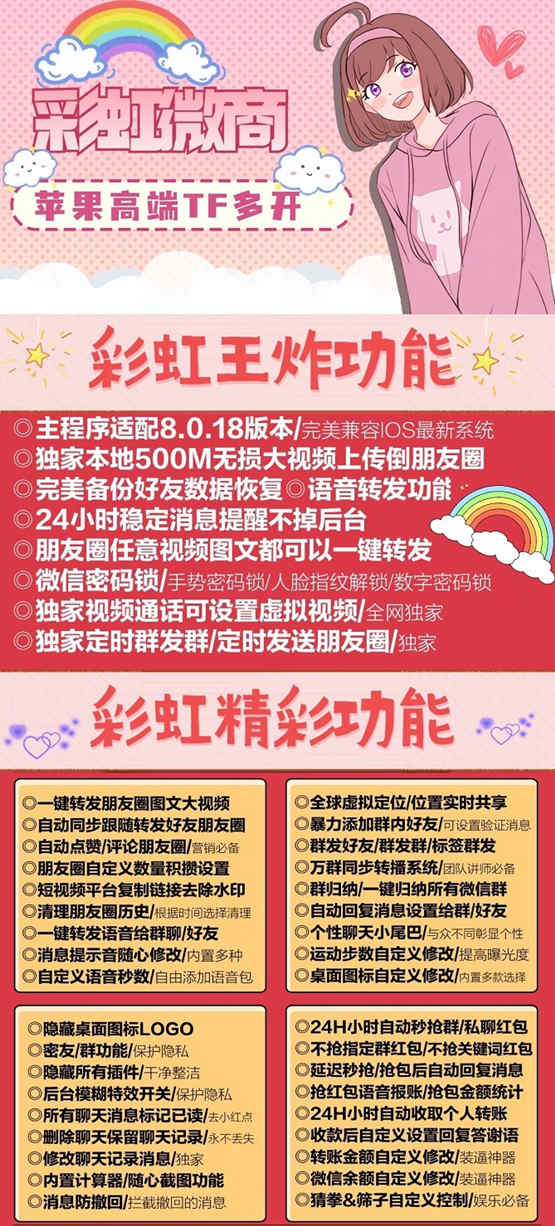

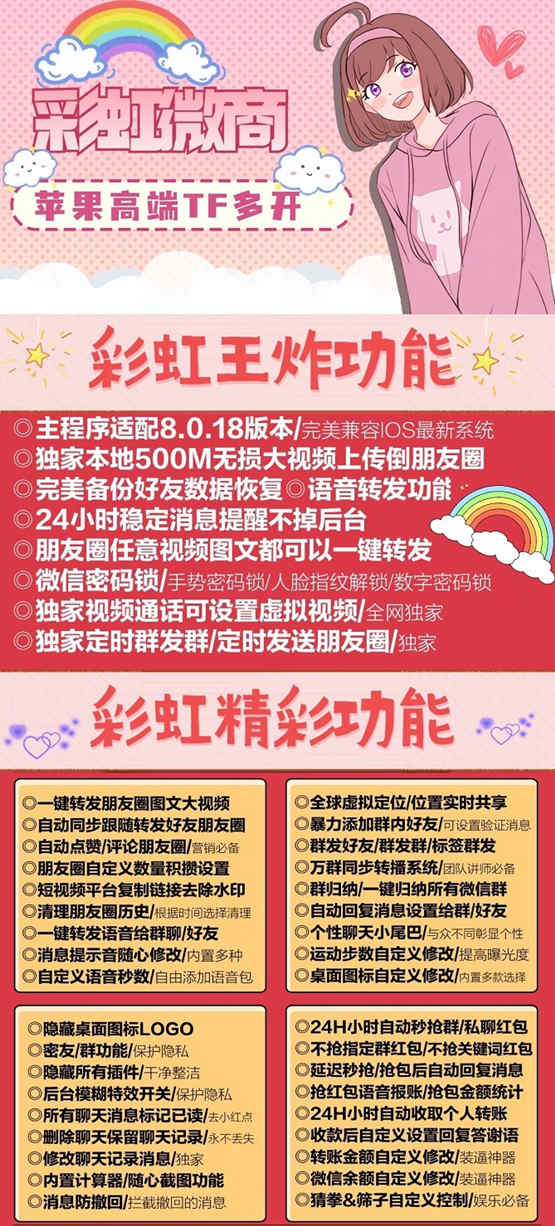

苹果彩虹微商激活码,苹果彩虹微商激活码,苹果彩虹微商多开,苹果彩虹微商微信,苹果彩虹微商分身,苹果彩虹微商功能在哪里,苹果彩虹微商1.0,苹果彩虹微商下载,苹果彩虹微商未信任,苹果彩虹微商教程,苹果彩虹微商代理,苹果彩虹微商使用教程,

主程序适配8.0.18版本/完美兼容IOS最新系统

独家本地500M无损大视频上传倒朋友圈

完美备份好友数据恢复◎语音转发功能

24小时稳定消息提醒不掉后台

朋友圈任意视频图文都可以一键转发

微信密码锁/手势密码锁/人脸指纹解锁/数字密码锁

独家定时群发群/定时发送朋友圈/独家

彩虹微商新地址mt.mm444.cc

Large corporations could not have grown to their present size without being able to find innovative ways to raise capital to finance expansion.

大公司如果没能想方设法筹集到扩展用的资金,是不可能成长到现在的体量的。

Corporations have five primary methods for obtaining that money.

公司筹集这些资金的方式主要有5种。

Issuing Bonds

发行债券

A bond is a written promise to pay back a specific amount of money at a certain date or dates in the future.

一份债券就是一个承诺,它许诺在未来的某一天或者某一段时间偿付一笔特定金额的钱。

In the interim, bondholders receive interest payments at fixed rates on specified dates.

在这之前,债券持有人会在特定日期收到固定利率的利息。

Holders can sell bonds to someone else before they are due.

在债券到期之前,持有人可以把债券卖给其他人。

Corporations benefit by issuing bonds because the interest rates they must pay investors are generally lower than rates for most other types of borrowing and because interest paid on bonds is considered to be a tax-deductible business expense. However, corporations must make interest payments even when they are not showing profits.

公司发行债券是有利可图的,因为他们在这种方式中需要向投资人支付的利率比在其他借款方式中都要低,另外也因为支付给债券的利息被视为是一种可以免税的业务支出。只不过,如果公司没有盈利,他们依旧需要支付利息。

If investors doubt a company's ability to meet its interest obligations, they either will refuse to buy its bonds or will demand a higher rate of interest to compensate them for their increased risk. For this reason, smaller corporations can seldom raise much capital by issuing bonds.

如果投资者怀疑一家公司履行支付利息义务的能力,他们要么会拒绝买它的债券,要么会要求一个更高的利率以补偿增长的风险。因为这个原因,小公司很少能通过发行债券来融资。

Issuing Preferred Stock

发行优先股

A company may choose to issue new "preferred" stock to raise capital.

一家公司可以选择通过发行新的优先股来融资。

Buyers of these shares have special status in the event the underlying company encounters financial trouble.

当相关公司遇到财务问题时,这些股份的购买者享有特殊的权限。

If profits are limited, preferred stock owners will be paid their dividends after bondholders receive their guaranteed interest payments but before any common stock dividends are paid.

如果公司的利润有限,优先股持有者会在债券持有者获得所保证的利息之后再获得他们的股息,这之后普通股持有者才会获得他们的股息。

Selling Common Stock

激活码发卡商城-多开分身类-安卓苹果的多开-电脑营销软件-抢群红包软件-云端跟随圈 ,请猛戳这里→点击购买